What type of credit card user does the bank lose money on?

When customers fail to make their minimum payments, or when they default on their credit card debt altogether, the bank or credit card company can incur losses.

They're looking for customers who will revolve (but with premium cards they're often attracting the customers least likely to revolve balances). Banks lose money on some customers (who pay off their bills each month) while making money on those who pay monthly interest charges.

Yes every card company has a group of customers that they don't make much money on, they may even lose money on some of them. They still contribute to the company because they are still moving money through the system, and allow the credit card company to use the size of their customer base to set the merchant fees.

Answer and Explanation:

Among the types of credit card, the one that carries the most risk are: Unsecured credit cards that have variable interest rate. Unsecured credit cards are a type of credit card that would not require applicants for collateral.

The primary way that banks make money is interest from credit card accounts. When a cardholder fails to repay their entire balance in a given month, interest fees are charged to the account.

“Since credit card accounts are usually profitable, those accounts are almost always sold. In the unlikely event no one buys the credit card portfolio of a failed bank, the custodian will notify the cardholders that their accounts will be closed and to transfer their holdings, usually within 30 days.”

While the term "deadbeat" generally carries a negative connotation, when it comes to the credit card industry, you should consider it a compliment. Card issuers refer to customers as deadbeats if they pay off their balance in full each month, avoiding interest charges and fees on their accounts.

Yes, credit card companies do like it when you pay in full each month. In fact, they consider it a sign of creditworthiness and active use of your credit card. Carrying a balance month-to-month increases your debt through interest charges and can hurt your credit score if your balance is over 30% of your credit limit.

While credit card issuers don't make money through credit card interest if you pay your balance in full each month, they make money through credit card fees and miscellaneous charges. Credit card networks also charge merchants interchange fees for every purchase you make.

Generally, credit cards are a safer option than debit cards because they provide better protection against fraud.

How many credits cards is too many?

Owning more than two or three credit cards can become unmanageable for many people. However, your credit needs and financial situation are unique, so there's no hard and fast rule about how many credit cards are too many. The important thing is to make sure that you use your credit cards responsibly.

Its cards typically have low or no annual fees, no foreign transaction fees and rewards that can be redeemed with no minimum. With cards for business travelers, cash back rewards, students and limited credit, Capital One has an easy-to-use credit card for practically every type of consumer.

Of those countries, Visa is the clear winner, being the most popular credit card company in 123 countries. Surprisingly, American Express (AMEX) is the most popular in 23 countries including the UK and US. Finally, Mastercard was the most popular company in 22 countries including Canada and Australia.

According to an Experian consumer credit review, Americans have an average of 3.84 credit cards per person. While that may seem like too many for some, others may consider it not enough.

| Debt type | Average amount paid monthly |

|---|---|

| Mortgages | $1,855 |

| Auto loans | $690 |

| Personal loans | $517 |

| Credit cards | $272 |

Even if you don't pay fees or interest, using your credit card generates income for your issuer thanks to interchange — or swipe — fees. You can minimize fees and interest payments with responsible card use, including timely payments, avoiding cash advances and understanding your card's terms and conditions.

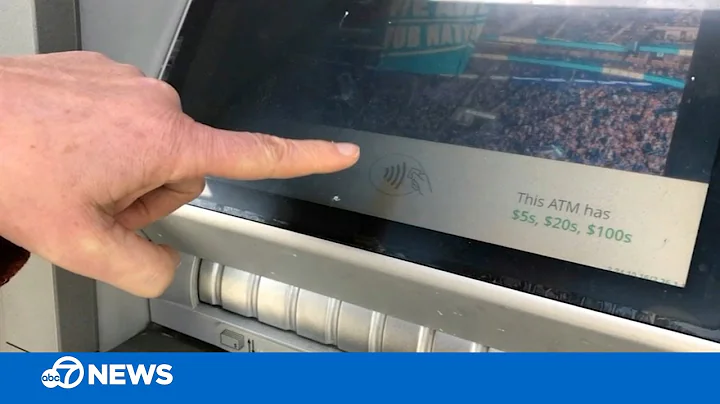

Digital wallets like Apple Pay are continuing to grow in popularity. Banks are worried they're losing ground to tech companies eager to gain market share in consumer payments. One of traditional finance's biggest threats is Apple.

Banks also make money from a credit card's interchange fees or merchant fees: each time a retailer processes a credit card payment, it must pay an interchange fee, which is a percentage of the transaction amount.

The Federal Deposit Insurance Corp. (FDIC) insures bank accounts up to $250,000 per depositor, per account category. 1 So, unless your bank is not insured by the FDIC or you have deposited more than the FDIC limit, your money is safe if your bank fails.

Yes, a debt collector can take money that you owe them directly from your bank account, but they have to win a lawsuit first. This is known as garnishing. The debt collector would warn you before they begin a lawsuit.

Do I need to worry about my bank collapse?

"People who have their money in insured accounts have nothing to worry about," said Mark Hamrick, senior economic analyst at Bankrate.com. "Simply make sure that deposits fall within the guaranteed limits, whether it's FDIC or the credit union equivalent."

- Your monthly rent or mortgage payment. ...

- A large purchase that will wipe out available credit. ...

- Taxes. ...

- Medical bills. ...

- A series of small impulse splurges.

Usually used as a derogatory term, a deadbeat in the credit card world is someone who pays off their balance in full every month. Deadbeats often reap the rewards from credit card programs without having to pay high fees or interest due to regular and full payments on their cards.

noun. Informal. a person who deliberately avoids paying debts or neglects responsibilities. Informal. a loafer; sponger.

To sum things up, the answer is no, it isn't bad to have a zero balance on your credit cards. In fact, having a zero balance or close-to-zero balance on your credit cards can be beneficial in many ways.